- Mobility Rising

- Posts

- African automakers are starting to feel the cost of US tariffs

African automakers are starting to feel the cost of US tariffs

Dear subscriber, this is a prototype. Please help us with feedback and tips. Just press reply.

South Africa’s auto exports to the US fell by 73% in the first quarter of 2025 compared to the same period in 2024, according to the industry’s association Naamsa. This worsened in April and May, with declines of 80% and 85%, underlining the impact of the 30% import tariff imposed by US President Donald Trump. South Africa is Africa’s second largest vehicle manufacturer. |

This impacts not just fuel vehicles but also EVs including the BMW X3 plug-in hybrids (PHEV) as well as the Ford Ranger PHEV, which is also exclusively produced in the country.

The continent’s largest auto manufacturer, Morocco, labours under a 10% tariff despite a free-trade agreement. Its auto exports to the US are expected to show a major hit similar to South Africa.

Our take: Trade restrictions will limit Africa’s emerging EV manufacturers from accessing lucrative global markets… Read more (2 min)

The average rate on loans from three of South Africa’s major banks to purchase an EV rose from 7.5% in June to 7.54% in July, an analysis by Mobility Rising shows. We analysed rates on EV loans from leading financiers in three major African economies namely South Africa, Kenya and Nigeria. In Kenya and Nigeria, interest rates remained unchanged during the month. |

We conduct the survey every first week of the month, and our latest findings show the majority of loans last between 12 and 60 months.

In the last three months, EV loans in the three countries have been largely stable, with minor adjustments in South Africa. This stability offers buyers predictability in their monthly instalments.

Our take: Interest rates are expected to remain relatively stable in Nigeria but minor changes are expected in Kenya and South Africa… Read more (2 min)

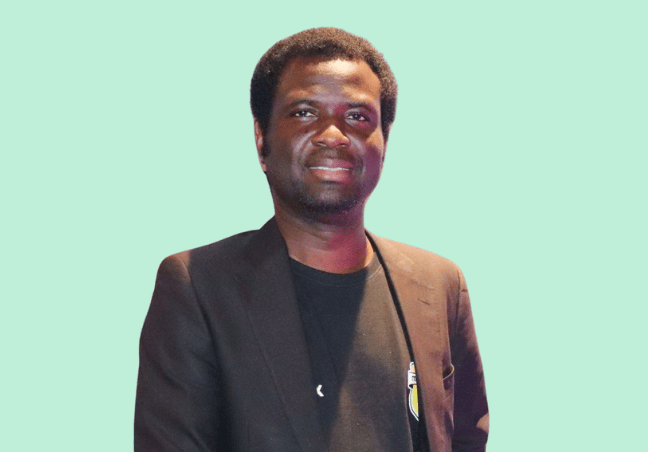

The narrative around EVs often revolves around battery range, infrastructure and cost, yet the most pressing barrier in emerging markets is financial access, says Adetayo Bamiduro, the CEO of Nigerian EV startup MAX. In countries such as Nigeria, Ghana, Cameroon and Sierra Leone, lending rates often exceed 25%, limiting the leap to electric mobility. |

Mr Bamiduro has served as CEO of MAX since its launch in 2015 and has raised over $60 million to expand beyond Nigeria.

If the current financing gap isn’t addressed, EV ownership will remain a luxury accessible to only a few, says Mr Bamiduro. Scaling inclusive e-mobility solutions will require joint action from all stakeholders.

South Africa’s KPMG associate Director Hideki Machida (left) poses in front of Maxus eTerron 9

Events

🗓️ Register for Public Transportation Electrification in Africa webinar (July 23)

🗓️ Get your pass for the Africa E-Mobility Week in Ethiopia (Oct 14)

🗓️ Prepare for Africa Investment Forum in Morocco (Nov 26)

Jobs

🔌 Become an EV charging lead at Kabisa (Rwanda)

💼 Apply for Customer Operations Manager at M-Kopa (Kenya)

👷🏻♀️ Join Ampersand as a Senior Engineering Manager (Rwanda)

Various

🔋 Spiro launches of its first solar-powered battery swap station at Abuja, Nigeria

🤝 Ampersand partners with ASA International to boost consumer financing

🚀 South Africa sends 100 graduates to China for EV training

Seen on LinkedIn

Flora Limukii, Spiro’s head of PR and communications, says, “A change of mindset, progressive EV policies, and strong financial support are the keys to unlocking EV adoption across Africa.”