- Mobility Rising

- Posts

- Electric SUVs see rising popularity in Africa

Electric SUVs see rising popularity in Africa

From the newsletter

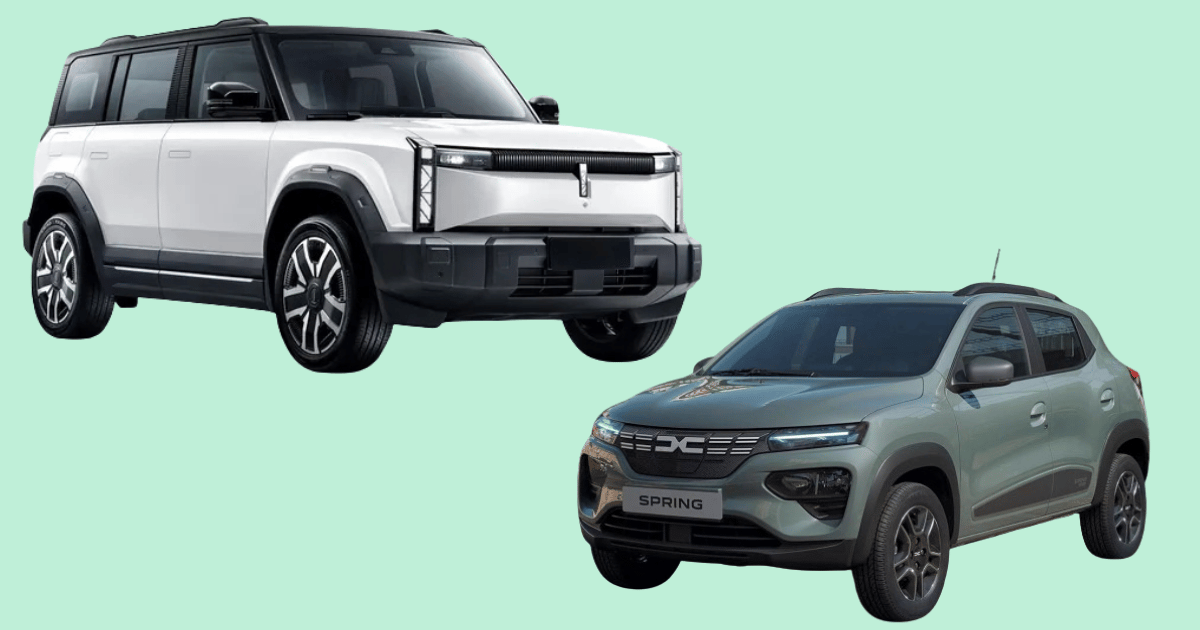

Two electric SUVs are set to enter the African market soon amid increased demand. Chery, a major Chinese automaker, plans to launch the iCAUR in the first quarter of 2026 in South Africa. The model has both hybrid and fully electric variants. Meanwhile, Dacia, a Romanian brand under the Renault Group, will debut its all-electric Spring SUV in Morocco next week.

Egypt, Morocco, and South Africa remain top entry points for global OEMs, but rising competition is intensifying as new entrants seek to gain market share and challenge locally assembled EVs.

The growing influx of EV brands and models signals strong market confidence, particularly in the readiness of charging infrastructure and supportive ecosystems in these key countries.

More details

iCAUR (also referred as iCar) is preparing to enter the South African market, with plans to establish 15 dealerships across major cities by launch. While details on which models will be introduced locally are yet to be confirmed, the brand is already active in markets such as China, India, and Malaysia. Its current lineup includes the iCar 03, iCar 03T, and iCar V23, with driving ranges between 301 and 520 km.

The iCar 03 is available in rear- and all-wheel drive versions, using CATL batteries that offer up to 501 km of range. The sportier iCar 03T adds off-road styling, intelligent four-wheel drive, and rapid acceleration, reaching 50 km/h in just 3.0 seconds. Meanwhile, the V23 is a rugged SUV offering up to 401 km of range, with hybrid versions expected soon.

Dacia will begin selling the all-electric Spring in Morocco from 22 July at a price of 204,000 dirhams (around $22,400), with monthly instalments starting at 1,190 dirhams ($130). The compact model delivers a 225 km range, two powertrain options (33 kW and 48 kW), and supports fast DC charging up to 80% in under an hour.

Electric SUVs are making steady inroads into African markets, but affordability remains a key challenge. Recent entrants like the BYD Sealion 7 and Sealion 6 DM‑i hybrid in South Africa, and the BYD Atto 3 across East Africa, highlight growing interest, yet their high prices raise concerns about accessibility for average consumers in lower-income markets.

Dacia and iCAUR will face tough competition from established Chinese brands. In Morocco, the Spring will compete with models like the Kia EV5 ($45,000–$54,000) and Zeekr 7X (~$46,500), while in South Africa, iCAUR’s SUVs will go head-to-head with BYD models priced between $33,600 and $56,000. Their success will hinge on pricing, and strong after-sales service to stand out against both imports and locally built EVs.

Increased competition is likely to benefit consumers, as more brands enter with a mix of premium and budget-friendly options. Affordable models like the Spring and BYD Atto 3 could pressure OEMs to improve pricing or offer flexible financing. Over time, this could make EVs more attainable across the continent, especially with supportive policies and growing production scale.

Our take

EVs assembled in Africa tend to be more expensive than imports because local manufacturers deal with high input costs, including imported parts and limited local component production. Additionally, smaller production volumes and limited government subsidies make it hard to compete with mass-produced imported models.

Electric SUVs are priced at a premium and are likely to attract only high-income earners in Africa. This restricts their market reach and slows down wider EV adoption among the general population.

With new EVs priced beyond the reach of many, most Africans are turning to second-hand electric vehicles as a more affordable alternative. These used imports help fill the market gap but often come with a limited warranty and uncertain battery life.