- Mobility Rising

- Posts

- Ethiopian Airlines ushers in a new era of electric mobility

Ethiopian Airlines ushers in a new era of electric mobility

From the newsletter

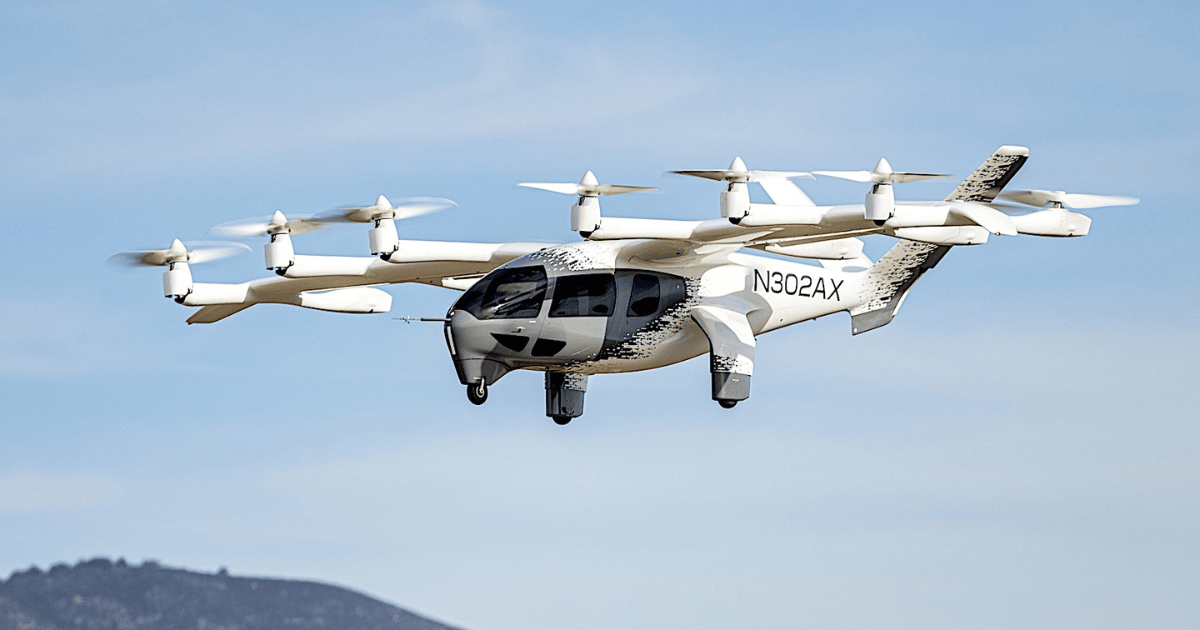

Africa’s largest carrier, Ethiopian Airlines, will receive two electric air taxis from US-based Archer Aviation in 2026. With a price tag of around $5 million each, these will be the first electric air taxis, commonly known as eVTOLs, to be deployed commercially in Africa. The Archer Midnight eVTOL aircraft has a 161 km range but is optimised for short flights of around 32 km.

eVTOL (electric vertical take-off and landing) aircraft are future alternatives to helicopters. Electricity is cheaper than aviation fuel, maintenance is simpler, and insurance costs are potentially lower as the technology matures.

A growing number of African companies are working on eVTOLs to beat traffic in congested cities. Fahari Aviation, a subsidiary of Kenya’s national carrier Kenya Airways, aims to launch eVTOLs in 2028.

More details

Ethiopian Airlines and Archer signed the agreement in March 2025. The deal is part of Archer’s “Launch Edition” programme valued at up to $30 million. The programme is a commercialization strategy for Archer’s Midnight eVTOL aircraft, focusing on deploying the aircraft in early adopter markets ahead of full US type certification. Other key partners in the program include Abu Dhabi Aviation and PT. IKN in Indonesia.

The companies will work together to over time build an air taxi network in the region, with Archer planning to provide Ethiopian Airlines with a team of pilots, technicians, and engineers to support the initial deployment of these early launch edition Midnight aircraft in Ethiopia.

While the two companies will primarily focus on developing an air taxi network in the region, they will also explore other use cases, including eco-tourism. Ethiopia is a major tourism destination, boosted by Addis Ababa’s role as a diplomatic hub. The industry employs more than 2 million people and contributes about 6% of Ethiopia’s GDP.

This comes at a time when the eVTOL ecosystem in Africa is still in its very early stages. However, a few players — both local and international — are showing growing interest in introducing eVTOL technology to the continent.

While still in its nascent stages, the global eVTOL aircraft market size was estimated at $1.11 billion in 2020 and is projected to grow to $23.21 billion in 2028. This will be mainly driven by the significant investments from aerospace companies and startups, which are accelerating eVTOL development.

eVTOLs have significant potential to transform transportation in Africa, particularly because of the continent’s infrastructure gaps, vast distances, congested urban areas, and hard-to-reach rural communities. They can be deployed in various applications including eco-tourism, urban air mobility, emergency medical evacuations and logistics.

Major challenges however remain, which will slow down the adoption of eVTOLs in Africa. A key challenge is that there are no established vertiports, charging stations, or maintenance hubs in most African cities. Further, civil aviation authorities across Africa have not yet developed eVTOL-specific rules for airworthiness, pilot certification, or airspace integration.

Our take

Ethiopian Airlines' early adoption could pressure other leading African carriers like Kenya Airways’ Fahari Aviation and South African Airways as well as private aviation players to fast-track their own eVTOL plans to remain competitive in urban air mobility.

As eVTOL technology grows, major African cities like Addis Ababa, Nairobi, and Lagos could begin investing in dedicated vertiports and grid-powered charging infrastructure, catalyzing new partnerships between aviation authorities, utilities, and private developers.

Once air taxi services are proven viable, operators will likely expand into use cases like medical airlifts, cargo logistics, and remote-area connectivity, aligning with Africa’s unique geographic and infrastructure challenges.