- Mobility Rising

- Posts

- Indian EV companies race to catch up with China in Africa

Indian EV companies race to catch up with China in Africa

From the newsletter

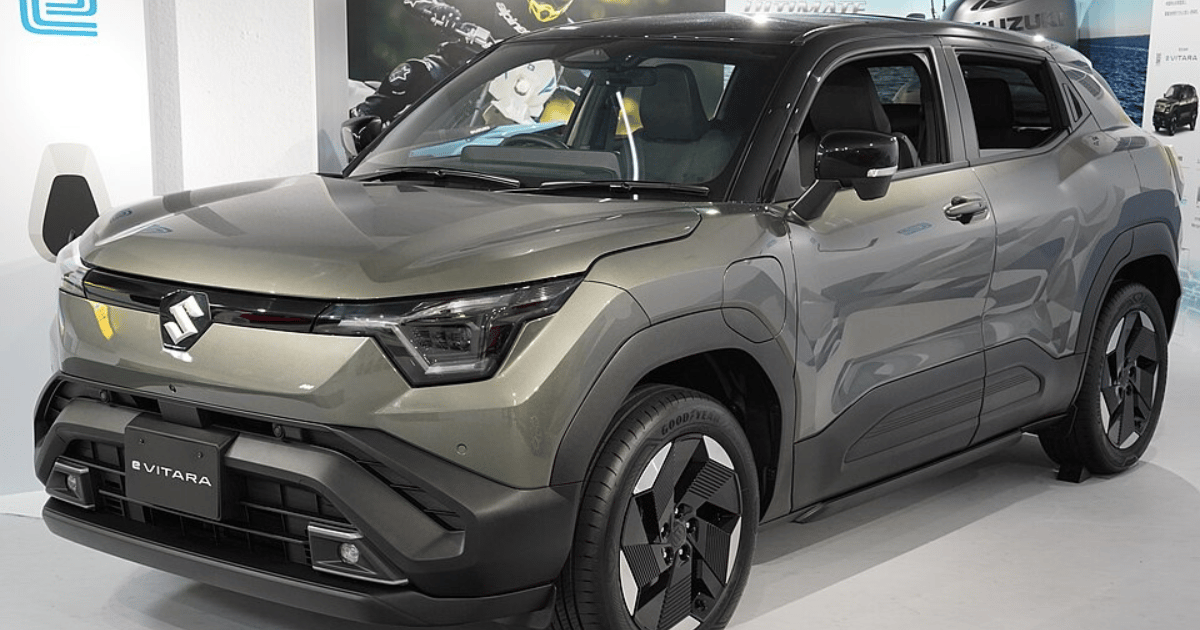

South Africa is one of 100 countries that are set to receive the e-Vitara, Maruti Suzuki’s first electric car, launched Thursday. Suzuki is India’s largest carmaker, and plans to make 67,000 units of the e-Vitara by March 2026. It is the latest Indian company to introduce EVs to Africa, following Tata Motors, Sun Mobility and Switch Mobility. Mahindra has said it will follow suit.

The majority of EV companies in Africa are from China, which also remains the main source of EV parts and components that are used for assembly in Africa.

Indian companies like TVS and Bajaj currently dominate Africa’s motorcycle market. Automakers like Maruti Suzuki and Tata are looking to borrow a leaf from their playbook to capture a share of the continent’s growing EV market.

More details

The e-Vitara will be available in standard-range FWD, long-range FWD and long-range AWD versions. The standard-range FWD variant features a 49 kWh battery pack, while the long-range FWD and AWD models use a 61 kWh pack. All versions employ LFP cells supplied by BYD. The standard-range FWD and long-range FWD models are fitted with a 106 kW motor, delivering ranges of 344 km and 426 km respectively.

The car’s launch comes just days after Tata Motors, another Indian auto giant, announced its return to South Africa after its 2019 exit, and is doing so in partnership with automotive group Motus as its exclusive distributor. Tata’s EV lineup is made up of Tiago.ev, Tigor.ev, Punch.ev, Nexon.ev, Curvv.ev, and Harrier.ev. It has future concepts like the Avinya and Sierra.ev in its development pipeline. Before heading to South Africa, Tata had earlier this year first introduced its EVs in Mauritius.

Mahindra, one of India’s top auto producers, is also seeking to introduce electric cars to Africa. Mahindra South Africa CEO Rajesh Gupta in August said the company plans to bring two fully electric models, already launched in India, to South Africa once the local infrastructure and business conditions are favourable. Mahindra currently manufactures fuel vehicles in the country.

But India and China are not the only Asian companies that are positioning themselves to capture Africa’s EV market. Japan has been the leading motor vehicle seller in Africa with its popular brands like Toyota, Honda and Nissan. These companies are also investing in EVs, with gradual entry into the continent. South Korean companies like Hyundai and Kia are also bringing their EV lineups. At the same time, companies from Indonesia, the Philippines and Sri Lanka are also coming into the market.

EVs from European companies like Mercedes-Benz, Volkswagen, Porsche, Volvo and BMW are also popular, especially in Egypt and South Africa. in South Africa for instance, Volvo has for years been the top EV seller. These European companies, in addition to US firms like Tesla and Ford, are making competition stiff. However, Chinese companies like BYD are likely to win out in the longer run due to their aggressive price cuts.

While only an estimated 11,000 electric cars were sold in Africa in 2024, this number is expected to go up by more than double in 2025 going by the growth trends in recent years. Major economies like South Africa, Egypt, Morocco, Kenya, Nigeria and Ethiopia are expected to contribute a significant share of sales. Chinese companies, especially BYD, are expected to dominate sales during the year.

Our take

Indian automakers like Maruti Suzuki, Tata and Mahindra are known for their cheap cars, which has helped them gain market share in Africa. If they can replicate the same in EVs and produce low-cost models, they could grow sales on the continent quickly.

The success of new entrants will heavily depend on their ability to build robust local partnerships. Tata Motors' collaboration with Motus in South Africa is a prime example of this strategy. Other companies, including Maruti Suzuki and Mahindra may follow suit, partnering with local distributors to establish dealership networks, after-sales service, and potentially, local assembly operations.

Motorcycles from Indian companies like TVS and Bajaj are known in Africa for their affordability, durability, and a strong service network. This has been their winning formula. If the likes of Tata follow this blueprint, they will be able to compete more favourably with the increasingly popular Chinese brands.