- Mobility Rising

- Posts

- Stellantis to boost EV manufacturing capacity sixfold

Stellantis to boost EV manufacturing capacity sixfold

From the newsletter

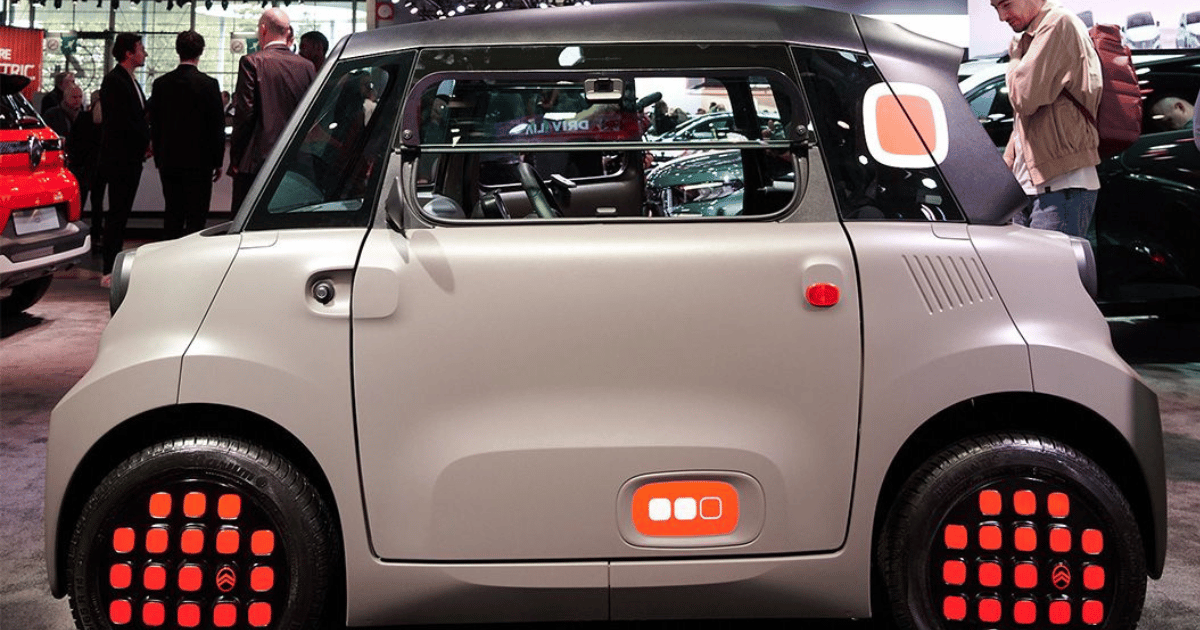

Global carmaker Stellantis has announced plans to boost electric vehicle production at its Kenitra factory in Morocco from 20,000 to 70,000 units for models such as the Citroën Ami, Opel Rocks-e, and Fiat Topolino. The expansion will also add a new annual capacity of 65,000 electric three-wheelers (Fiat Tris). The project is supported by a $1.4 billion investment.

The rising demand for EVs in European Union (EU) countries is one of the main reasons Stellantis is boosting its production. Morocco has now overtaken China and Japan to become the top car exporter to the EU.

The partnership between Stellantis and the Moroccan government is a good example of how public-private cooperation can drive growth. The country aims to produce more than 107,000 EVs by the end of this year.

More details

Stellantis opened its Kenitra plant in 2019 and has since grown its output to 230,000 vehicles annually, primarily ICE vehicles. With the latest expansion, production will more than double to 535,000 units and create 3,000 new jobs, with operations set to begin in February 2026.

The $1.4 billion investment will also scale up EV production to 135,000 units per year and introduce hybrid engine manufacturing, targeting 350,000 units annually. The first batch of mild-hybrid engines began production in May 2025, while component machining will follow in November 2026.

From July 2025, the Kenitra plant will also start producing over 204,000 electric charging stations per year. The facility’s local sourcing rate is projected to rise from 69% to 75% by 2030. This deepening of local value chains is likely to reduce costs, boost domestic industry, and make Morocco more competitive in global EV supply networks.

Once fully operational, Morocco is set to become Africa’s leading EV manufacturer and assembler, overtaking South Africa and Egypt, which will rank second and third respectively based on the Mobility Rising project database. This shift reflects a broader continental trend where North African nations are emerging as industrial leaders due to infrastructure, port access, and EU trade ties. It signals a rebalancing of Africa’s automotive map, where traditional players like South Africa face increased competition from newer, strategically positioned entrants.

Stellantis’ dual investment in both hybrid and EV models offers a flexible response to Africa’s diverse mobility and affordability needs. Hybrids may appeal more in countries where charging infrastructure is limited or unreliable, while EVs can serve urban centres with growing clean energy integration. This balanced approach gives Stellantis a competitive edge across income segments and energy readiness levels.

Stellantis’ move into EV charger production, joining companies like Algeria’s SAIEG, is a strategic step that may accelerate North Africa’s role in supplying the continent’s clean mobility infrastructure. The fact that charger production exceeds its own EV output suggests ambitions beyond its own supply chain. This could help catalyse Africa-wide EV adoption by addressing a critical bottleneck: access to reliable and scalable charging networks.

Our take

By entering the EV charger space, Morocco can become a central hub in Africa’s clean mobility supply chain. Distributors and suppliers stand to benefit from easier access to locally produced components, reducing reliance on imports and lowering logistics costs.

Morocco’s growing EV ecosystem is backed by ongoing infrastructure upgrades and targeted industrial policies. These efforts create a predictable and supportive environment for investors, enabling long-term planning and reduced operational risks.

With the lowest EV production labour costs globally, Morocco offers a highly competitive base for investors and OEMs looking to scale manufacturing in Africa. This cost advantage allows for better margins and improved pricing flexibility across regional markets.