- Mobility Rising

- Posts

- Japanese event rekindles hopes for EV investment

Japanese event rekindles hopes for EV investment

From the newsletter

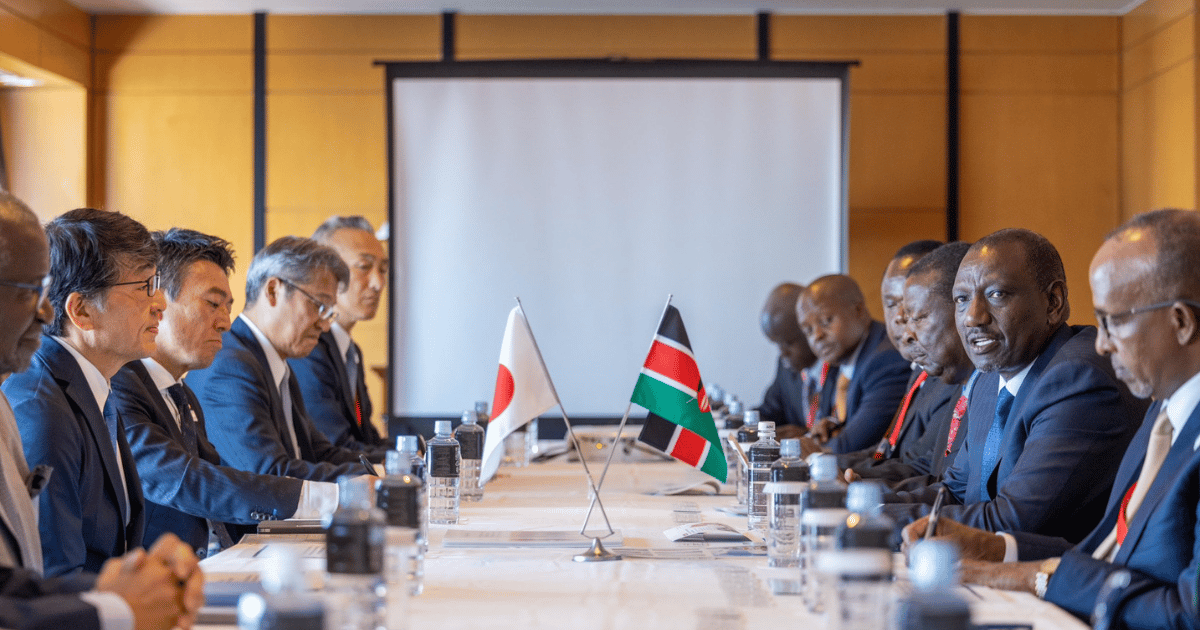

Mobility companies expect to receive investment from Japan at an increased rate following the successful conclusion of the 9th Tokyo International Conference on African Development (TICAD). The conference saw Japan and various African nations enter into 300 cooperation agreements, including several geared towards enhancing investment in Africa’s EV sector.

A number of African EV companies made the journey to Japan for the conference, where they pitched for investment. Japan’s private sector also used the TICAD business expo to showcase their investments in African electric mobility firms.

Kenya secured a $170 million loan from Japan, part of which will be used to support local EV manufacturing.

More details

TICAD 9 saw both Japanese and African companies showcase their electric mobility innovations and solutions. Musashi Seimitsu Industry, a Japanese automotive parts giant, exhibited its battery-swappable electric motorcycles developed with Nairobi-based ARC Ride. Musashi is an investor in ARC Ride.

Another major Japanese player in Africa’s electric mobility sector that made a contribution during TICAD is Toyota Tsusho, the backer of venture capital firm Mobility 54, which invests in clean mobility and logistics companies in Africa. Some of the companies that have received investment from Mobility 54 include Kenya-based electric bus company BasiGo and Ugandan electric motorcycle company Zembo.

A significant portion of Japanese investment in African electric mobility comes from venture capital firms that back startups such as the aforementioned Mobility 54. Others include Uncovered Fund and Monex Ventures, Samurai Incubate Funds Africa, and Verod-Kepple Africa Ventures. Japan government-backed agencies like the Japan International Cooperation Agency (JICA) and Nippon Export and Investment Insurance (NEXI) have also provided support for clean mobility solutions on the continent.

While Japan is emerging as a source of capital for Africa’s electric mobility companies, it is still a long way from funding received from private investors based in the US, UK and the European Union. Besides private investors, European development finance institutions such as FMO (Netherlands), Swedfund (Sweden), and InfraCo Africa (UK) are also investing heavily in African EV startups.

The TICAD 9 conference has however come at a time when funding raised by Africa’s EV companies has gone down significantly over the last one year, dealing a major blow to their expansion plans. For example, while mobility companies have raised $119 million in funding in the first seven months of 2025, they had already raised more than $200 million by that stage in 2024.

Asia is therefore emerging as an alternative source of capital for EV companies that are looking to raise money. Besides Japan, other Asian countries that are showing promise from an investment perspective are China and India, which are already big players in the EV industry. Funding from foreign investors has become key for the growth of the sector as many African banks and investors perceive the EV market as untested and risky, leading to slower capital inflows.

Our take

With Western funding slowing in recent months, Japanese venture capital firms and agencies could step in to fill the gap, making Japan one of the top foreign backers of African EV companies.

Collaborations like the one that Musashi has with ARC Ride, where Japanese firms bring advanced EV technology and capital while African startups contribute local market knowledge and operations, could help fast-track the sector’s growth.

Common-user production facilities can help African countries accelerate their EV assembly and manufacturing capacities. Such facilities would allow multiple businesses and entrepreneurs to share access to shared facilities, machinery, and technical support to produce EVs, lowering costs.