- Mobility Rising

- Posts

- We reveal the top EV technology changes

We reveal the top EV technology changes

From the newsletter

A measure introduced by China in July to restrict exports of key technologies used in the production of EV batteries tops our latest Technology Tracker. Mobility Rising tracks technological developments in the EV sector across the world every month. In August, we analyse all the major trends and new innovations that have taken place over the last two months.

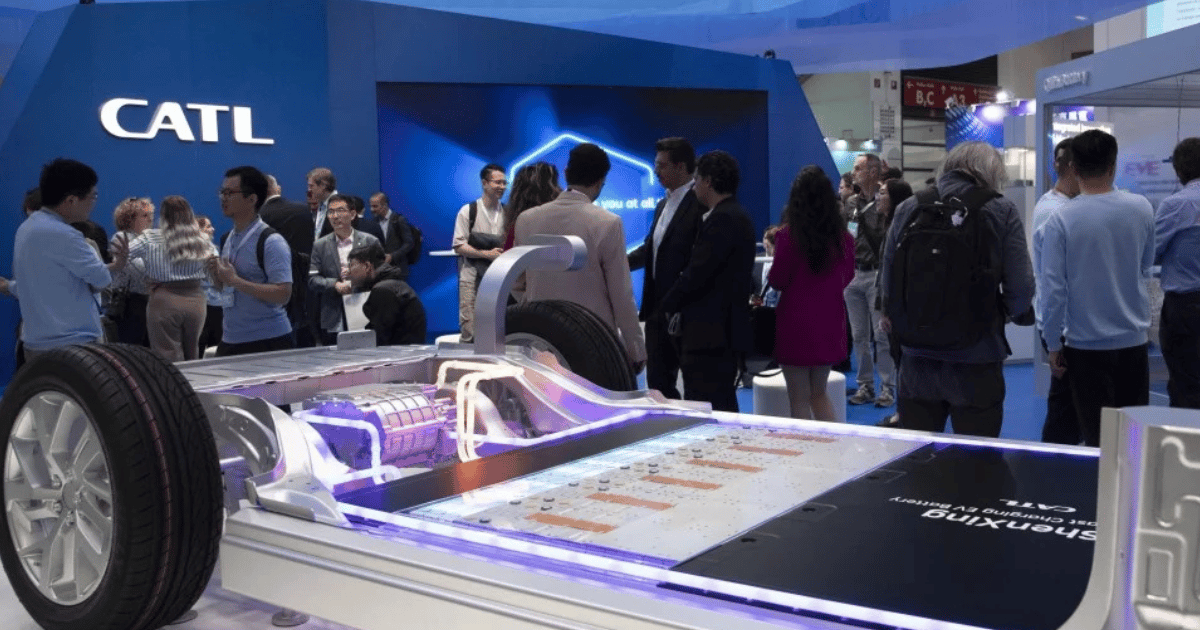

Battery production technologies and lithium processing techniques have now been included on China’s export control list. The move is part of a broader effort to firm up dominance in the global EV battery market.

Africa will be hit as it relies on EV battery imports, mainly from China. Countries like Morocco are building major battery plants, mainly using Chinese tech.

More details

China supplies over 80% of the world’s batteries. The ban means that any transfer of EV battery technology overseas, whether through trade, investment, or technical cooperation, must first receive special approval from the government. The global market share by Chinese companies also exceeds 80% for key components like cathodes and anodes in 2023. This dominance is driven by massive domestic demand, vertical integration across the supply chain.

One of the key innovations during the last eight weeks is a new technology that extends the life and range of electric vehicle batteries developed by Chinese researchers. A new state-of-charge (SOC) technology, developed by researchers at the Huayin Institute of Technology, extends the range of EV batteries by precisely determining the charge. Researchers believe that the ability to accurately track battery status could help develop more efficient fast-charging systems while maintaining battery health.

Moroccan researcher Hussein Al-Maatawi, from Mohammed VI Polytechnic University (UM6P), has garnered global attention for his work on cobalt-free lithium-ion battery technologies. Cobalt has long been a key component in lithium-ion batteries, particularly in the cathode, the part responsible for storing and releasing lithium ions. However, it is toxic and expensive. Al-Maatawi's latest research focuses on a method called fluorine anion doping in single-particle nickel oxide and lithium cathodes, with the goal of producing high-performance, cost-effective, and cleaner lithium-ion batteries.

In the same period, a research collaboration led by Swansea University recently secured funding to develop sodium-ion battery (SIB) technology for electric mobility applications in Sub-Saharan Africa. The StamiNa project, partnering with institutions in the UK, Kenya, and Nigeria, will refine SIB production utilising Prussian White cathodes and coal-derived hard carbon anodes, aiming to exceed the energy density of current SIBs and compete with lithium iron phosphate (LFP) performance.

Similarly, a team of researchers has gathered under an EU-funded initiative named PHOENIX, aiming to develop batteries that can heal themselves. Their goal is to extend battery life, make them safer and reduce the need for new battery metals. Scientists from Belgium, Germany, Italy, Spain and Switzerland are collaborating to design sensors that detect changes within a lithium-ion battery as it ages, and trigger the battery’s self-healing when needed. The aim is to double the lifetime of the batteries and, by extension, the life of EVs.

Our take

African countries like Morocco are dependent on imported EV battery tech. China’s trade restrictions could lead to higher costs and slower access to innovation, potentially leading to a shift to battery technologies from other markets such as Japan, the EU, and India to fill the gap.

Africa’s contribution to global technological breakthroughs in the EV sector is minimal. However, projects like the Swansea University-led sodium-ion project signals that Africa may start contributing to the global EV tech landscape, not just as a consumer, but as a testing ground for affordable, scalable alternatives.

China’s state-of-charge advancement shows it’s still racing ahead on efficiency and range, but its trade restrictions may accelerate a diversification of R&D globally. This could lead to more EU and US funding in battery innovation, with Africa positioned as a key beneficiary of pilot projects in low-cost EV applications.